Can You Roll a Qualified Annuity Into an Ira

Rolling over some of your retirement savings into an annuity which will eventually provide guaranteed, secure lifetime income can be the answer to a lot of questions and concerns you have about supporting yourself after you've retired.

With the demise of pensions for most workers, many have found themselves on their own to chart out their retirement finances. The big question they face is: How do they do it?

Imagine you've built up a sizable retirement savings in your employer-sponsored retirement plan or your own IRA account, and you're getting ready to retire. But without a pension, how do you make sure you have continuous income to fund your retirement years? Social Security won't cut it. It's too little, and who knows how long it will be there?

How do you use your savings to fund your retirement? How much can you withdraw at a time? How do you know how long you'll need the money to last? What if you run out of money? What if you spend too little because you're afraid of running out of money? In other words, how can you make the funds in your 401(k) or IRA more like a pension?

One popular option is to use a portion of the funds to purchase an annuity, which will provide you a stream of income like a pension.

The income can be structured to last the rest of your lifetime, or, if you are married, for two lifetimes. And if you don't want lifetime income, you can create an income that lasts for a set period of time — 15 years, for example.

Your financial advisor can help you build a plan that is right for you.

Wendy Swanson, Retirement Income Certified Professional with Annuity.org, explains how you can roll over your 401(k) or IRA into an annuity.

Using Retirement Savings to Fund an Annuity

Say you're interested in using your retirement funds to buy an annuity. Should you withdraw the funds from your retirement account, pay the taxes and then buy the annuity? Or can you just roll over the funds directly into the annuity, continuing to avoid taxes until you receive the income stream payments?

In most cases, the Internal Revenue Service allows qualified funds to be transferred into, or out of, qualified annuities.

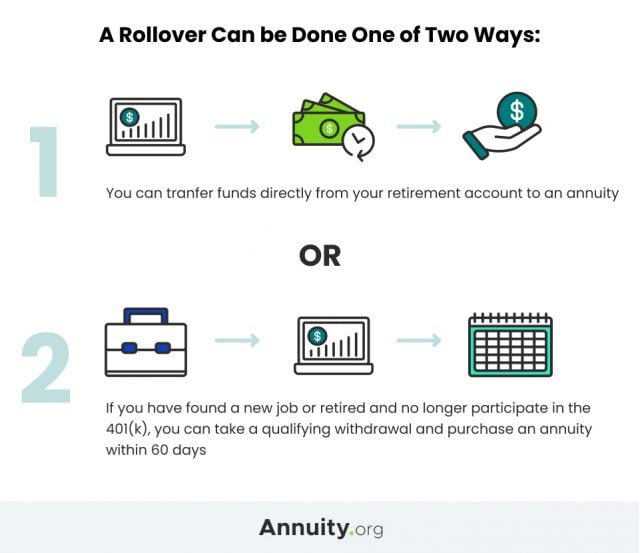

Direct rollovers occur when qualified funds move from one trustee to another trustee without touching the owner. Under these circumstances, direct transfers are tax-free. Direct transfers are commonly done by mailing or wiring funds directly to the new plan provider, but on some occasions the old plan provider may mail the check directly to you, payable to the new plan provider. This still counts as a tax-free direct transfer.

Indirect rollovers, however, are more complicated and have significant tax consequences if not executed correctly. Indirect rollovers occur when the participant takes constructive receipt of the funds. In order to remain tax-free, the funds must be rolled over within 60 days of distribution. Otherwise, the distribution is income taxable and may also be subject to the penalty for withdrawing funds prior to age 59½.

Indirect rollovers have other consequences as well. Distributions made from qualified retirement plans, such as 403(b) annuities and 457 plans, are subject to automatic withholding tax in the amount of 20 percent. Internal Revenue Code considers the withholding a distribution unless it is added to the 80 percent received and reallocated during the 60-day limit.

The advice here is simple: whenever possible use direct transfers.

Expand

Get Your Free Guide to Annuities

Learn from the experts and get our 101-level guide, Annuities Explained, delivered to your inbox for free.

How Do 401(k)s and IRAs Work?

A 401(k) is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401(k) accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

By and large 401(k) plans, known as defined contribution plans, have taken the place of pensions, known as defined benefit plans. 401(k)s are the primary vehicle of employer-sponsored retirement savings.

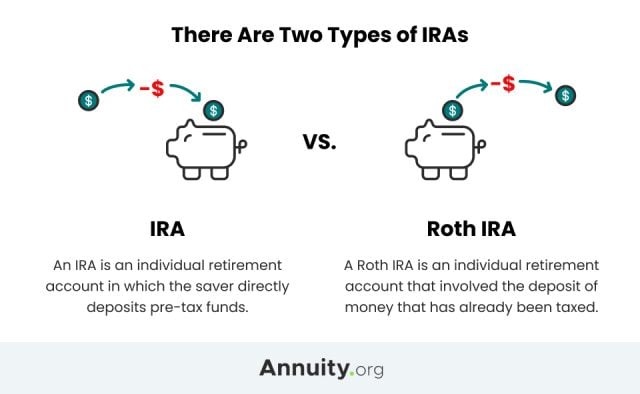

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401(k) plans will roll the funds from them into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59½, then the IRS levies an additional 10 percent penalty tax. The same rules of taxation apply when you roll a 401(k) plan or an IRA into an annuity.

Expand

Graphic explaining the difference between a standard IRA and a Roth IRA

Will You Have Enough Income in Retirement?

Strategies for the Rollover: Research Your Options

Determining how much of your retirement savings should be in an annuity should start with an analysis of your routine expenses. Ideally, you should make sure you have a guaranteed income stream to fund at least 80 percent of your budget. This income stream can come from Social Security, a pension or annuities.

When you consider rolling your retirement savings into an annuity, you should be familiar with the types of annuities and the benefits and drawbacks of each. Some investment advisors say that variable annuities are not a good option because they can be expensive, complicated and unpredictable. Fixed annuities, however, are less costly to the purchaser and more reliable as far as an income stream.

Fixed Annuities

Fixed annuities are less costly to the purchaser and more reliable as far as an income stream compared to variable annuities.

You should consult a financial advisor to chart out your budget moving forward and determine how much of your retirement savings should be used to purchase an annuity. You should determine what type of annuity works best for you and whether you should purchase specific riders to modify the contract to meet your needs.

You could also use various strategies, such as annuity laddering, which takes advantage of different types of annuities to construct the income stream you need, or a split-funded annuity, which enables you to get the best of different types of annuities.

Another possible strategy is to delay receiving the annuity income stream as long as possible. That's because your expected lifespan is part of the calculation an annuity provider uses to determine how big your payments will be. The shorter your life is projected to last, the higher the individual payments. Consequently, the older you are when you begin receiving payments, the higher the income payments will be.

Rolling Your Annuity into a 401(k)

Can you roll your annuity over into your 401(k)? It depends.

First, your annuity would need to already be an IRA annuity. And second, your 401(k) plan would have to allow you to roll money from other tax-deferred retirement plans into it.

You should check with the person in charge of your employer's plan. You should also check with your annuity provider and review the contract to make sure you're able to take the funds from the annuity.

Please seek the advice of a qualified professional before making financial decisions.

Last Modified: November 8, 2021

18 Cited Research Articles

Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

- Boyte-White, C. (2019, March 11). What are the risks of rolling my 401(k) into an annuity? Retrieved from https://www.investopedia.com/ask/answers/093015/what-are-risks-rolling-my-401k-annuity.asp

- Brooks, R. (2018, April 13). How to Turn Your 401(k) or IRA Into Retirement Income. Retrieved from https://money.usnews.com/money/retirement/articles/2018-04-13/how-to-turn-your-401-k-or-ira-into-retirement-income

- Cowels, T. (n.d.). Should I Roll My 401(k) Into an Annuity? Retrieved from https://money.com/collection-post/should-i-roll-my-401k-into-an-annuity/

- Decker, F. (n.d.). Can You Roll Over a 401(k) Into an Immediate Income Annuity? Retrieved from https://budgeting.thenest.com/can-roll-over-401k-immediate-income-annuity-31509.html

- Dias, C. (2018, March 8). Pension Possibilities: IRA Rollover? Buy an Annuity? Or Take the Payout? Retrieved from https://www.kiplinger.com/article/retirement/t020-c032-s014-how-should-you-take-your-pension-payout.html

- Hanson, S. (2014, November 24). New 401(k) annuities can make retirement income a sure thing. Retrieved from http://nbr.com/2014/11/24/new-401k-annuities-can-make-retirement-income-a-sure-thing/

- Internal Revenue Service. (n.d.). Topic Number 413 – Rollovers from Retirement Plans. Retrieved from https://www.irs.gov/taxtopics/tc413

- Lake, R. (2018, September 14). Converting An IRA To An Annuity? Read This First. Retrieved from https://smartasset.com/retirement/converting-an-ira-to-an-annuity

- Lohrey, J. (n.d.). Can I Roll Over My 401(k) to a Tax-Deferred Annuity? Retrieved from https://finance.zacks.com/can-roll-over-401k-taxdeferred-annuity-9012.html

- McClintock, L. (2017, April 19). Can an Annuity Be Rolled Over to a 401(k)? Retrieved from https://pocketsense.com/can-annuity-rolled-over-401k-2581.html

- Moisand, D. (2015, January 19). Better to roll 401(k) money into a pension than an annuity. Retrieved from https://www.marketwatch.com/story/better-to-roll-401k-money-into-a-pension-than-an-annuity-2015-01-19

- Motley Fool. (n.d.). Can an annuity Be Rolled Over to a 401(k)? Retrieved from https://www.fool.com/knowledge-center/can-an-annuity-be-rolled-over-to-a-401k.aspx

- Motley Fool. (n.d.). What Are the Tax Implications When an IRA Is Converted to an Annuity? Retrieved from https://www.fool.com/knowledge-center/tax-implications-when-an-ira-is-converted-to-an-an.aspx

- Myers, R. (n.d.). Turn Your 401(k) into a Pension Plan. Retrieved from https://www.wsj.com/ad/article/annuities-401k

- Rodeck, D. (n.d.). Tax Implications for When IRA Is Converted to an Annuity? Retrieved from https://finance.zacks.com/tax-implications-ira-converted-annuity-2428.html

- Sams, M. (n.d.). How to Help a Client Roll Their 401(k) or IRA Into a Fixed Annuity. Retrieved from https://blog.newhorizonsmktg.com/how-to-help-a-client-roll-their-401k-or-ira-into-a-fixed-annuity

- Updegrave, W. (2016, February 3). When an annuity makes sense for you. Retrieved from https://money.cnn.com/2016/02/03/retirement/retirement-savings-annuity/

- Voigt, K. (2019, April 16). Annuity vs. IRA: Which is Best for My Retirement? Retrieved from https://www.nerdwallet.com/blog/investing/annuity-vs-ira-which-is-best/

Can You Roll a Qualified Annuity Into an Ira

Source: https://www.annuity.org/retirement/401k-ira-annuity-rollover/

0 Response to "Can You Roll a Qualified Annuity Into an Ira"

Post a Comment